For Individuals

At Gain Wealth, we offer first-class wealth management solutions. we put our passion to work to develop customised products for discerning private individuals and sophisticated institutional clients. We strive to offer our clients customised solutions in line with their needs.

Insurance Solutions

-

What is your biggest financial asset? You might think it is your home or perhaps your car, but the reality is, your greatest asset is your income. If you lost your ability to earn an income, would you be able to sustain your standard of living and make loan repayments on government welfare payments?

Having suitable income protection is particularly important for people who are self-employed or are small business owners. Like any other insurance, there are variables that will determine the premiums you pay for income protection. These premiums are tax deductible, helping you to reduce your tax.

At GAIN we can help you choose the best cover for your needs and circumstances. There are other types of insurances for Life, Trauma, and Total and Permanent Disability (hyperlink these), talk to us today to see what combination would be right for you.

-

Having life insurance can help give you peace of mind. With a life insurance policy, your loved ones will be helped financially by ensuring your debts and dependants are taken care of in the event of your death.

At GAIN we will sit down with you and help you work out what level of insurance is right for your situation and tailor a product that works for you.

-

Trauma insurance allows you to receive a lump sum payment in the event you are diagnosed with a certain medical condition (each policy will vary, but the conditions can commonly be cancer, heart attack, stroke or a bad accident). Trauma insurance offers peace of mind in the knowledge that if the worst was to occur, neither you nor your family would suffer financially as a result whilst you are recovering.

A Trauma policy may ensure that you are able to accommodate any lifestyle changes that you may require after your diagnosis, pay for the best available medical treatment or it may just help you focus on recovery after an operation without worrying about debt repayments and getting back to work.

Whatever the situation, a Trauma policy is designed to relieve financial stress after a medical diagnosis, so you and your family can focus on your health and quality of life.

At GAIN we can work with you to determine the level of Trauma insurance you might need. -

Money is the last thing you or your loved ones would like to think about if faced with a lifelong disability. In the event of total and permanent disability, a huge emotional strain is placed on a family support someone who may require full-time care.

Total and Permanent Disability (TPD) Insurance is designed to provide a lump sum benefit to you in the event of an incident that renders you unable to work again. TPD Insurance is generally used to assist with full-time care or cover off your debts and your ongoing living expenses to reduce the ongoing financial burden of loss of income.

At GAIN we can provide you with information on the benefits of TPD insurance and what it covers so can decide if it is suitable for you.

Financial Planning Solutions

-

How much super will you have in retirement and will it be enough? What if you were to put more in your Super now? What are the benefits? If utilised fully, your superannuation can assist with your asset protection, investing, estate planning and tax objectives.

We can guide you in choosing the best Super fund and options to suit your particular needs. The earlier you take control of your Super, the greater the impact you can have on your retirement options.

-

A Self-Managed Superannuation Fund (SMSF) is a popular choice amongst Australians employees and the self-employed for the range of benefits its offers such as:

- Investment control, flexibility and range of options

- Ability to use your super to invest in real estate

- Tax advantages and concessions

Whilst SMSFs may offer attractive incentives, the complexity and regulatory requirements around managing your own Super means it is definitely an area where you should seek professional advice before deciding if it is the right option for you. At GAIN we know that one size does not fit all when it comes to SMSF and we can advise you on whether a SMSF will suit your needs.

-

Have you considered how you will support yourself once you retire? Will you still have debts to manage or perhaps you would like to retire before you are eligible for the Age Pension?

If you plan for it, it is possible that your retirement can be a delight and not a difficulty. At GAIN we can guide you in planning for your retirement by helping you make decisions about your assets and income sources for when you retire. Don’t leave it too late, come in for a chat with one of our advisors today.

-

When it comes to Investment management the GAIN approach is simple. We take in to consideration three things:

- Your financial and investment goals.

- Your circumstances and what stage of life you are in.

- Your attitude to investing, do you have a conservative or aggressive approach to risk?

We believe that Investment is a long term strategy and we will collaborate with you to ensure you are well equipped and empowered to make sound and informed Investment decisions based on your financial goals.

-

At Gain, we believe successful investment has very little to do with good luck. There are tried and tested principles you can follow which can vastly improve your ability to achieve your goals and avoid disaster. We will take the time to help you work out an investment plan and help you choose investments that suit your goals and needs.

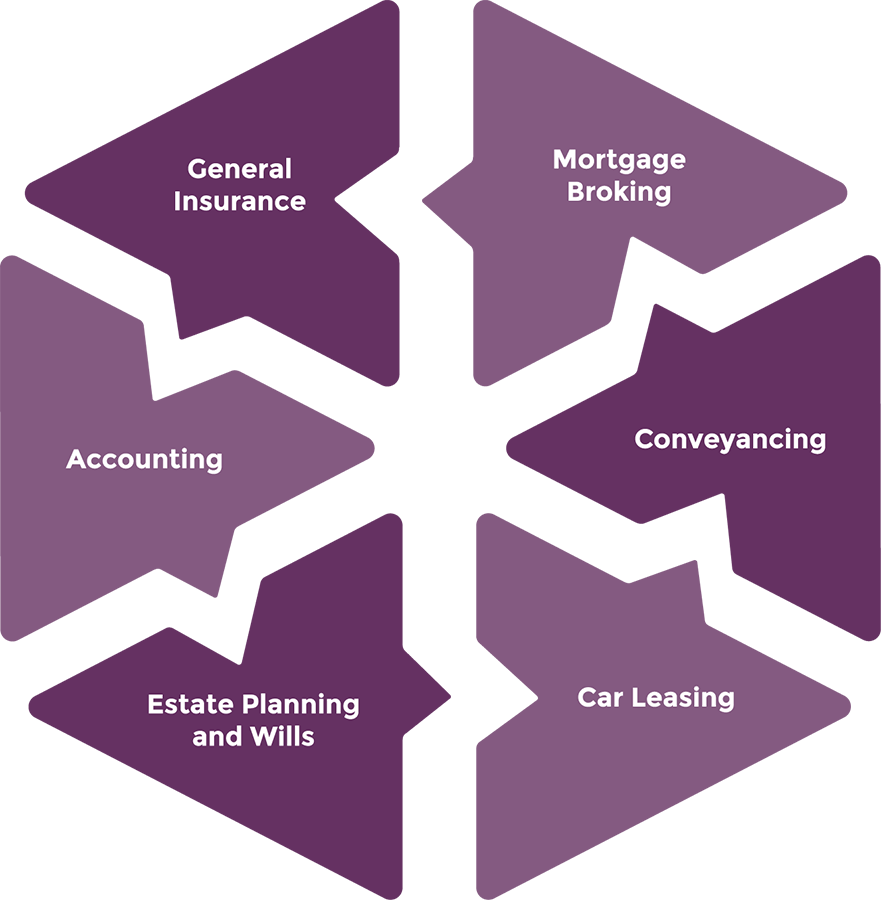

Our Affiliate Services

As part of our holistic approach to your financial care, we are aligned with industry leaders

in the following services:

Contact us today to enquire about our partner services to ensure you receive the

best deals our affiliate companies can offer.

Contact us